Cyber Insurance Market Overview:

The cyber insurance market has experienced significant growth in recent years, driven by the increasing frequency and severity of cyberattacks. With businesses across various sectors embracing digital transformation, the risk of data breaches, ransomware, and other cyber threats has surged. This trend has heightened the awareness of cyber insurance as a crucial component of a robust cybersecurity strategy. Cyber insurance provides financial protection and risk management solutions to businesses, helping them mitigate the financial impact of cyber incidents.

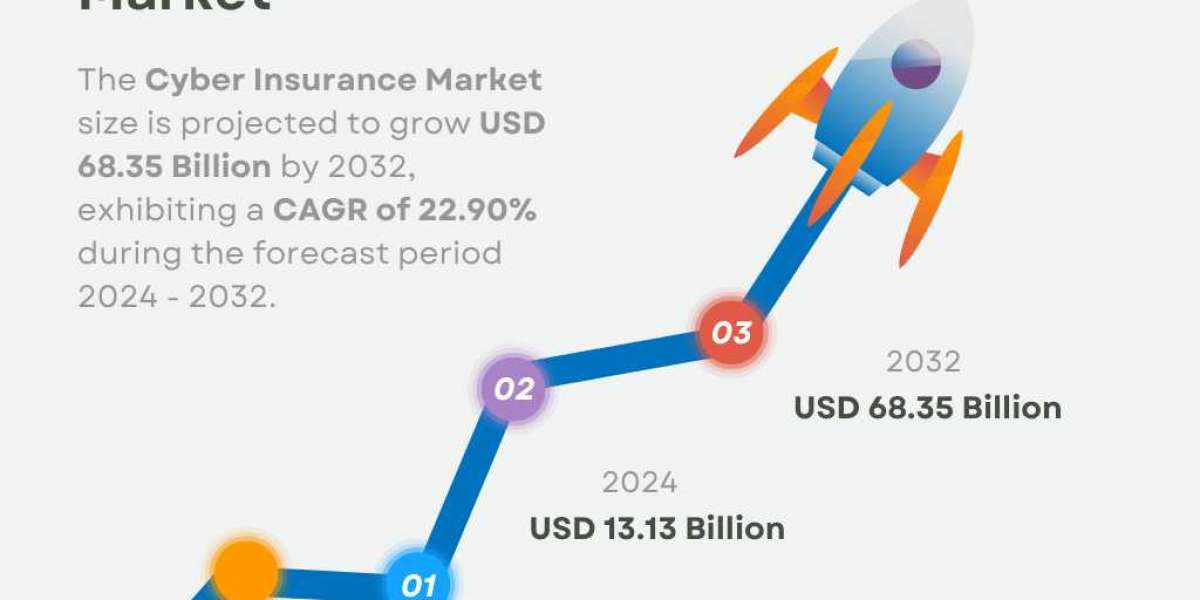

In 2024, the Cyber Insurance Market size is projected to grow from USD 13.13 Billion in 2024 to USD 68.35 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 22.90% during the forecast period (2024 - 2032). This remarkable growth can be attributed to the increasing adoption of digital technologies, stringent regulatory requirements, and the rising cost of data breaches. Companies of all sizes are now recognizing the need to safeguard their digital assets and ensure business continuity in the face of cyber threats.

Get a sample PDF of the report at –

https://www.marketresearchfuture.com/sample_request/8635

Industry News:

The cyber insurance market is witnessing dynamic changes as insurers continuously adapt to the evolving cyber threat landscape. One of the significant trends is the incorporation of advanced technologies such as artificial intelligence (AI) and machine learning (ML) to assess and underwrite cyber risks more accurately. These technologies enable insurers to analyze vast amounts of data and identify patterns, enhancing their ability to predict and prevent cyber incidents.

Another noteworthy development is the collaboration between cyber insurance providers and cybersecurity firms. By partnering with cybersecurity experts, insurers can offer comprehensive risk management solutions that go beyond financial coverage. These partnerships often include proactive measures such as vulnerability assessments, threat intelligence, and incident response services, providing policyholders with a holistic approach to cybersecurity.

Market Segmentation:

The cyber insurance market can be segmented based on coverage type, organization size, industry vertical, and region.

Coverage Type: The market primarily offers two types of coverage: first-party and third-party. First-party coverage includes costs related to data breaches, such as notification expenses, legal fees, and business interruption losses. Third-party coverage, on the other hand, addresses liabilities arising from lawsuits filed by affected parties, including customers and business partners.

Organization Size: Cyber insurance policies cater to both small and medium-sized enterprises (SMEs) and large corporations. SMEs are increasingly adopting cyber insurance to protect themselves from potentially devastating financial losses, while large corporations require more comprehensive coverage due to their extensive digital infrastructure and higher risk exposure.

Industry Vertical: Different industries face varying levels of cyber risk, influencing their demand for cyber insurance. Key industry verticals include healthcare, financial services, retail, manufacturing, and information technology. The healthcare and financial services sectors are particularly vulnerable to cyberattacks due to the sensitive nature of the data they handle, driving significant demand for cyber insurance in these industries.

Request for customization of this research report at -

https://www.marketresearchfuture.com/ask_for_customize/8635

Market Key Players:

The cyber insurance market is highly competitive, with several key players striving to expand their market share. Prominent companies in this space include:

- AIG (American International Group, Inc.)

- Chubb Limited

- AXA XL

- Zurich Insurance Group

Regional Analysis:

The cyber insurance market exhibits regional variations in terms of adoption and growth.

North America: North America, particularly the United States, dominates the global cyber insurance market. The high frequency of cyberattacks, stringent data protection regulations, and the presence of numerous large enterprises drive the demand for cyber insurance in this region.

Europe: Europe is another significant market for cyber insurance, with countries such as the United Kingdom, Germany, and France leading the way. The implementation of the General Data Protection Regulation (GDPR) has heightened the awareness of cyber risks and the importance of cyber insurance among European businesses.

Asia-Pacific: The Asia-Pacific region is witnessing rapid growth in the cyber insurance market, fueled by the increasing digitization of economies and rising cyber threat landscape. Countries like China, Japan, and Australia are at the forefront of this growth, with businesses across various sectors seeking robust cyber insurance solutions.

Latin America and the Middle East Africa: These regions are also experiencing a gradual increase in cyber insurance adoption. As businesses in these regions become more aware of the potential financial impact of cyber incidents, the demand for cyber insurance is expected to rise steadily.

Browse a Full Report –

https://www.marketresearchfuture.com/reports/cyber-insurance-market-8635

Recent Developments:

The cyber insurance market continues to evolve with several recent developments shaping its future trajectory. One notable trend is the increasing focus on comprehensive risk assessment. Insurers are enhancing their underwriting processes by leveraging advanced data analytics and threat intelligence to provide more accurate risk assessments. This approach helps in pricing policies more effectively and offering tailored coverage to policyholders.

Additionally, there is a growing emphasis on regulatory compliance. With data protection regulations becoming more stringent worldwide, businesses are under pressure to comply with these laws to avoid hefty fines and reputational damage. Cyber insurance providers are assisting businesses in navigating these regulatory requirements and ensuring compliance.

Furthermore, the rise of ransomware attacks has prompted insurers to offer specialized coverage for such incidents. Ransomware insurance covers the costs associated with ransom payments, data recovery, and business interruption, providing crucial financial support to businesses targeted by these attacks.

The cyber insurance market is poised for substantial growth, driven by the increasing prevalence of cyber threats and the need for robust risk management solutions. As businesses continue to invest in digital transformation, the demand for comprehensive cyber insurance coverage will only intensify, making it an essential component of modern business strategies.

Top Trending Reports:

Autonomous Mobile Manipulator Robots Market

Low Code Development Platform Market

Rugged Handheld Devices Market

IIOT Gateway for Utility Market

Contact

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: [email protected]

Website: https://www.marketresearchfuture.com